Cheyenne Credit Unions: Discover Top Financial Solutions in Your Area

Cheyenne Credit Unions: Discover Top Financial Solutions in Your Area

Blog Article

Unlock Exclusive Advantages With a Federal Cooperative Credit Union

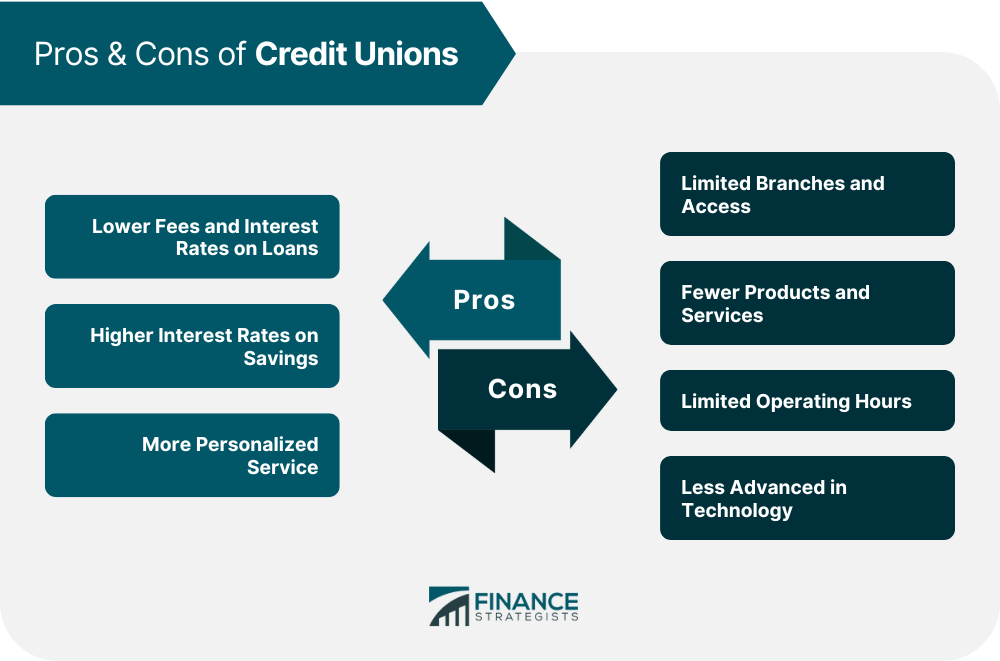

Federal Credit Unions offer a host of exclusive benefits that can dramatically influence your monetary health. From improved cost savings and examining accounts to reduced passion rates on car loans and customized monetary preparation services, the benefits are customized to assist you save money and attain your financial goals much more effectively. But there's more to these benefits than just monetary advantages; they can additionally provide a complacency and neighborhood that exceeds traditional banking services. As we check out further, you'll discover just how these unique advantages can genuinely make a difference in your economic trip.

Membership Eligibility Standards

To become a member of a government lending institution, people have to satisfy details qualification requirements established by the organization. These criteria vary depending on the specific lending institution, but they typically consist of aspects such as geographic location, employment in a certain market or company, membership in a particular organization or association, or household relationships to present members. Federal cooperative credit union are member-owned economic cooperatives, so eligibility needs remain in location to make certain that individuals who sign up with share a typical bond or organization.

Enhanced Cost Savings and Checking Accounts

With enhanced cost savings and checking accounts, federal debt unions provide participants premium financial products made to enhance their cash management approaches. In addition, federal credit scores unions usually provide online and mobile financial solutions that make it practical for participants to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By utilizing these enhanced cost savings and inspecting accounts, members can maximize their financial savings possible and effectively manage their daily funds.

Reduced Interest Prices on Finances

Federal credit scores unions supply members with the advantage of lower rate of interest on finances, enabling them to obtain money at more inexpensive terms compared to various other banks. This benefit can lead to considerable financial savings over the life of a financing. Lower rate of interest suggest that borrowers pay less in interest fees, decreasing the general cost of loaning. Whether participants require a car loan for an auto, home, or individual costs, accessing funds with a federal lending institution can bring about much more desirable repayment terms.

Personalized Financial Preparation Provider

Provided the emphasis on improving members' monetary well-being with reduced rate of interest rates on loans, federal credit history unions additionally use customized economic preparation services to aid people in accomplishing their long-term economic goals. By examining revenue, expenditures, obligations, and assets, federal credit report union monetary planners can assist participants create a thorough economic roadmap.

Additionally, the personalized financial planning solutions provided by federal credit score unions usually come with a lower price contrasted to personal monetary advisors, making them much more easily accessible to a bigger series of people. Participants can gain from expert advice this page and experience without incurring high costs, straightening with the credit report union ideology of prioritizing participants' financial health. Overall, these services aim to empower participants to make educated monetary choices, construct wealth, and safeguard their economic futures.

Access to Exclusive Member Discounts

Members of federal credit history unions enjoy special accessibility to a variety of member discount rates on various products and solutions. Wyoming Federal Credit Union. These discount rates are an click for source important perk that can assist participants conserve cash on everyday expenditures and unique purchases. Federal credit unions frequently partner with sellers, solution companies, and various other businesses to supply discount rates specifically to their participants

Members can take advantage of price cuts on a range of items, including electronic devices, clothes, traveling plans, and extra. On top of that, solutions such as vehicle leasings, hotel bookings, and enjoyment tickets might likewise be available at reduced rates for lending institution members. These unique price cuts can make a significant distinction in members' budget plans, enabling them to take pleasure in cost savings on both vital products and deluxes.

Final Thought

To conclude, signing up with a Federal Lending institution provides many advantages, consisting of enhanced savings and checking accounts, lower rates of interest on car loans, individualized economic planning solutions, and access to special member price cuts. By becoming a member, people can profit from a variety of monetary perks and solutions that can aid them conserve money, prepare for the future, and enhance their connections to the regional neighborhood.

Report this page